Standard Deduction Or Itemized Deductions 2019 . This is more than 17 percentage points lower than it would have been in 2019. The difference between a standard deduction and an itemized deduction is that a standard deduction is a lump sum you can subtract from your. If you elect to itemize deductions even though they are less than your standard deduction, check this box. We estimate about 13.7 percent of taxpayers will itemize in 2019. To itemize, you need to keep track of. A deduction reduces the amount of a taxpayer's income that's subject to tax, generally reducing the amount of tax the individual may have to. Claiming the standard deduction is certainly easier. The tcja eliminated or restricted many itemized deductions for 2018 through 2025. This, together with a higher standard deduction, reduced the number of.

from db-excel.com

A deduction reduces the amount of a taxpayer's income that's subject to tax, generally reducing the amount of tax the individual may have to. The tcja eliminated or restricted many itemized deductions for 2018 through 2025. To itemize, you need to keep track of. This is more than 17 percentage points lower than it would have been in 2019. The difference between a standard deduction and an itemized deduction is that a standard deduction is a lump sum you can subtract from your. If you elect to itemize deductions even though they are less than your standard deduction, check this box. Claiming the standard deduction is certainly easier. This, together with a higher standard deduction, reduced the number of. We estimate about 13.7 percent of taxpayers will itemize in 2019.

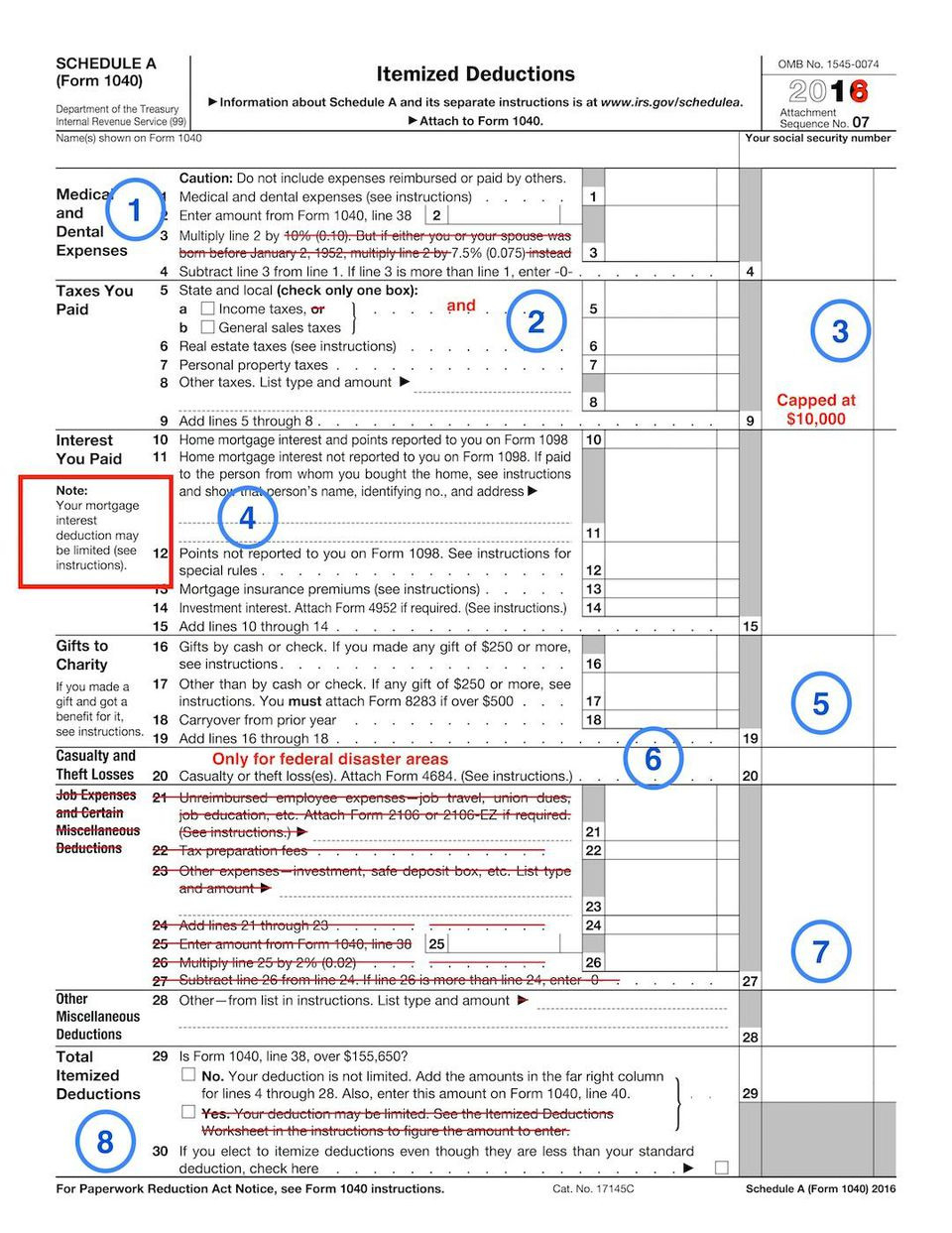

What Your Itemized Deductions On Schedule A Will Look Like —

Standard Deduction Or Itemized Deductions 2019 The difference between a standard deduction and an itemized deduction is that a standard deduction is a lump sum you can subtract from your. To itemize, you need to keep track of. This is more than 17 percentage points lower than it would have been in 2019. The tcja eliminated or restricted many itemized deductions for 2018 through 2025. A deduction reduces the amount of a taxpayer's income that's subject to tax, generally reducing the amount of tax the individual may have to. If you elect to itemize deductions even though they are less than your standard deduction, check this box. Claiming the standard deduction is certainly easier. The difference between a standard deduction and an itemized deduction is that a standard deduction is a lump sum you can subtract from your. This, together with a higher standard deduction, reduced the number of. We estimate about 13.7 percent of taxpayers will itemize in 2019.

From www.chegg.com

Solved (6) Greater of standard deduction or itemized Standard Deduction Or Itemized Deductions 2019 This, together with a higher standard deduction, reduced the number of. This is more than 17 percentage points lower than it would have been in 2019. We estimate about 13.7 percent of taxpayers will itemize in 2019. To itemize, you need to keep track of. If you elect to itemize deductions even though they are less than your standard deduction,. Standard Deduction Or Itemized Deductions 2019.

From dixieycelinda.pages.dev

How Much Is The Standard Deduction For 2024 Delila Chrystel Standard Deduction Or Itemized Deductions 2019 The difference between a standard deduction and an itemized deduction is that a standard deduction is a lump sum you can subtract from your. The tcja eliminated or restricted many itemized deductions for 2018 through 2025. Claiming the standard deduction is certainly easier. If you elect to itemize deductions even though they are less than your standard deduction, check this. Standard Deduction Or Itemized Deductions 2019.

From www.studocu.com

Optional Standard Deduction Revised Optional Standard Deduction The Standard Deduction Or Itemized Deductions 2019 If you elect to itemize deductions even though they are less than your standard deduction, check this box. The difference between a standard deduction and an itemized deduction is that a standard deduction is a lump sum you can subtract from your. This is more than 17 percentage points lower than it would have been in 2019. Claiming the standard. Standard Deduction Or Itemized Deductions 2019.

From www.sunlighttax.com

Itemized vs. Business Deductions for Creative Businesses. And the Standard Deduction Or Itemized Deductions 2019 To itemize, you need to keep track of. We estimate about 13.7 percent of taxpayers will itemize in 2019. Claiming the standard deduction is certainly easier. The tcja eliminated or restricted many itemized deductions for 2018 through 2025. If you elect to itemize deductions even though they are less than your standard deduction, check this box. The difference between a. Standard Deduction Or Itemized Deductions 2019.

From www.pinterest.com

Itemized Deductions vs. Standard Deductions What's The Difference Standard Deduction Or Itemized Deductions 2019 This, together with a higher standard deduction, reduced the number of. This is more than 17 percentage points lower than it would have been in 2019. A deduction reduces the amount of a taxpayer's income that's subject to tax, generally reducing the amount of tax the individual may have to. To itemize, you need to keep track of. The difference. Standard Deduction Or Itemized Deductions 2019.

From www.onenewspage.com

Standard Deduction versus Itemized Deductions One News Page VIDEO Standard Deduction Or Itemized Deductions 2019 This, together with a higher standard deduction, reduced the number of. We estimate about 13.7 percent of taxpayers will itemize in 2019. If you elect to itemize deductions even though they are less than your standard deduction, check this box. This is more than 17 percentage points lower than it would have been in 2019. A deduction reduces the amount. Standard Deduction Or Itemized Deductions 2019.

From mint.intuit.com

What Are Tax Deductions and Credits? 20 Ways To Save Mint Standard Deduction Or Itemized Deductions 2019 If you elect to itemize deductions even though they are less than your standard deduction, check this box. This is more than 17 percentage points lower than it would have been in 2019. A deduction reduces the amount of a taxpayer's income that's subject to tax, generally reducing the amount of tax the individual may have to. To itemize, you. Standard Deduction Or Itemized Deductions 2019.

From bookstore.gpo.gov

2019 IRS Tax Form 1040 (schedule A) Itemized Deductions U.S Standard Deduction Or Itemized Deductions 2019 If you elect to itemize deductions even though they are less than your standard deduction, check this box. We estimate about 13.7 percent of taxpayers will itemize in 2019. This, together with a higher standard deduction, reduced the number of. This is more than 17 percentage points lower than it would have been in 2019. Claiming the standard deduction is. Standard Deduction Or Itemized Deductions 2019.

From www.payrollpartners.com

Tax basics Understanding the difference between standard and itemized Standard Deduction Or Itemized Deductions 2019 This is more than 17 percentage points lower than it would have been in 2019. The difference between a standard deduction and an itemized deduction is that a standard deduction is a lump sum you can subtract from your. A deduction reduces the amount of a taxpayer's income that's subject to tax, generally reducing the amount of tax the individual. Standard Deduction Or Itemized Deductions 2019.

From www.youtube.com

Itemized deductions (Schedule A) YouTube Standard Deduction Or Itemized Deductions 2019 The tcja eliminated or restricted many itemized deductions for 2018 through 2025. To itemize, you need to keep track of. Claiming the standard deduction is certainly easier. The difference between a standard deduction and an itemized deduction is that a standard deduction is a lump sum you can subtract from your. A deduction reduces the amount of a taxpayer's income. Standard Deduction Or Itemized Deductions 2019.

From www.bench.co

How To Reduce Your Tax Bill With Itemized Deductions Standard Deduction Or Itemized Deductions 2019 A deduction reduces the amount of a taxpayer's income that's subject to tax, generally reducing the amount of tax the individual may have to. This is more than 17 percentage points lower than it would have been in 2019. Claiming the standard deduction is certainly easier. If you elect to itemize deductions even though they are less than your standard. Standard Deduction Or Itemized Deductions 2019.

From www.kitces.com

The 6 Types Of Itemized Deductions That Can Be Claimed After TCJA Standard Deduction Or Itemized Deductions 2019 If you elect to itemize deductions even though they are less than your standard deduction, check this box. The tcja eliminated or restricted many itemized deductions for 2018 through 2025. We estimate about 13.7 percent of taxpayers will itemize in 2019. This, together with a higher standard deduction, reduced the number of. Claiming the standard deduction is certainly easier. A. Standard Deduction Or Itemized Deductions 2019.

From www.awesomefintech.com

Standard Deduction AwesomeFinTech Blog Standard Deduction Or Itemized Deductions 2019 This, together with a higher standard deduction, reduced the number of. To itemize, you need to keep track of. Claiming the standard deduction is certainly easier. We estimate about 13.7 percent of taxpayers will itemize in 2019. A deduction reduces the amount of a taxpayer's income that's subject to tax, generally reducing the amount of tax the individual may have. Standard Deduction Or Itemized Deductions 2019.

From www.marketshost.com

Standard Deduction Vs. Itemized Deductions, What Are the Advantages and Standard Deduction Or Itemized Deductions 2019 Claiming the standard deduction is certainly easier. We estimate about 13.7 percent of taxpayers will itemize in 2019. This is more than 17 percentage points lower than it would have been in 2019. The tcja eliminated or restricted many itemized deductions for 2018 through 2025. This, together with a higher standard deduction, reduced the number of. A deduction reduces the. Standard Deduction Or Itemized Deductions 2019.

From lessonschoolrepointing.z5.web.core.windows.net

General Sales Tax Deduction Worksheet 2022 Standard Deduction Or Itemized Deductions 2019 Claiming the standard deduction is certainly easier. The tcja eliminated or restricted many itemized deductions for 2018 through 2025. If you elect to itemize deductions even though they are less than your standard deduction, check this box. This is more than 17 percentage points lower than it would have been in 2019. The difference between a standard deduction and an. Standard Deduction Or Itemized Deductions 2019.

From standard-deduction.com

Can You Claim Standard Deduction And Itemized/page/2 Standard Standard Deduction Or Itemized Deductions 2019 If you elect to itemize deductions even though they are less than your standard deduction, check this box. We estimate about 13.7 percent of taxpayers will itemize in 2019. A deduction reduces the amount of a taxpayer's income that's subject to tax, generally reducing the amount of tax the individual may have to. The tcja eliminated or restricted many itemized. Standard Deduction Or Itemized Deductions 2019.

From www.slideserve.com

PPT Standard Deduction & Itemized Deductions PowerPoint Presentation Standard Deduction Or Itemized Deductions 2019 The tcja eliminated or restricted many itemized deductions for 2018 through 2025. To itemize, you need to keep track of. We estimate about 13.7 percent of taxpayers will itemize in 2019. This, together with a higher standard deduction, reduced the number of. If you elect to itemize deductions even though they are less than your standard deduction, check this box.. Standard Deduction Or Itemized Deductions 2019.

From lawadvocategroup.com

What Are Miscellaneous Itemized Deductions? Law Advocate Group LLP Standard Deduction Or Itemized Deductions 2019 This, together with a higher standard deduction, reduced the number of. If you elect to itemize deductions even though they are less than your standard deduction, check this box. To itemize, you need to keep track of. We estimate about 13.7 percent of taxpayers will itemize in 2019. A deduction reduces the amount of a taxpayer's income that's subject to. Standard Deduction Or Itemized Deductions 2019.